Food Vendor Insurance Cost

Just how much is vendor insurance and how is the cost determined? We’re here to answer both of those questions and more, breaking down costs so you can get the best coverage for your food or beverage business.

How Much Does Food Vendor Insurance Cost?

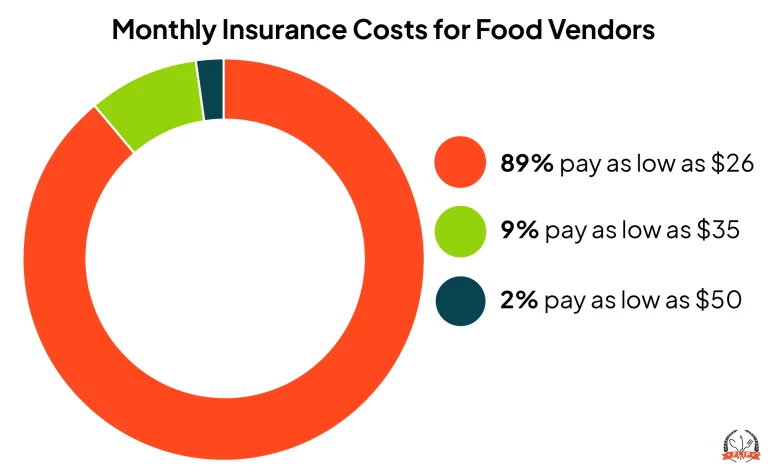

Food vendor insurance costs as low as $25.92 per month or $299 per year. This coverage includes third-party bodily injury, property damage, and product liability.

Your final pricing can vary depending on the additional coverage options you select and how much your business makes annually.

How Much Does Each Type of Coverage Cost?

What Factors Affect Food Insurance Cost?

Several factors can impact your food vendor insurance costs.

The cost of your general liability policy depends on how much your business earns annually. The higher your gross income, the higher your premium. For example:

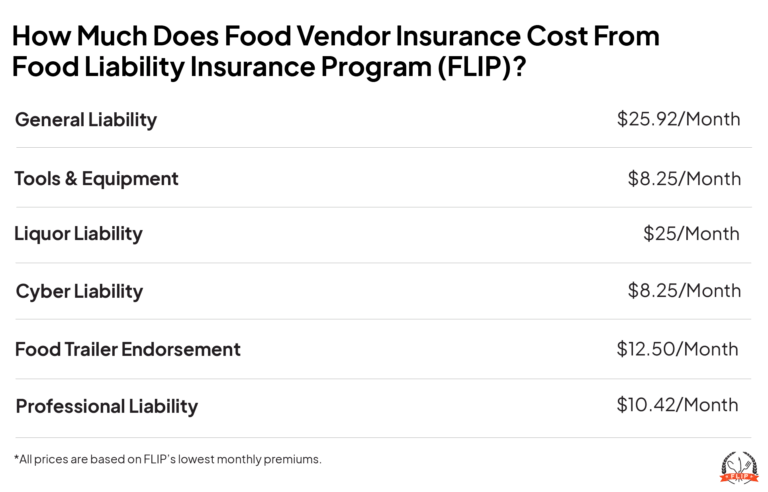

Another factor that influences your final price is the coverage you choose. FLIP offers several options that expand or extend your policy, including:

- Inland Marine (Tools and Equipment)

- Liquor Liability Insurance

- Cyber Liability Insurance

- Food Trailer Endorsement

- Workers’ Compensation Insurance

- Professional Liability Insurance

Your food vendor insurance cost can also increase if you have a history of filing expensive claims. Businesses with multiple claims may present more financial risk, so carriers offset this by raising premiums.

Choosing the right vendor insurance policy for your business comes down to weighing important factors like cost and coverage.

Can I Reduce the Cost of My Insurance?

FLIP offers the lowest rates possible for the best quality coverage. While we can’t discount the starting price, you can ensure you keep your costs down by mitigating your risk.

While some accidents are inevitable, many potentially costly catastrophes can be avoided with preparation and awareness. For example:

- Conduct daily inspections of your food truck, cart, trailer, or booth to ensure you adhere to all health and safety standards.

- Keep the area in and around your business clean and free of any tripping hazards.

- Label all of your food and storage clearly with ingredients and dates.

- Store all refrigerated and frozen items at the appropriate temperatures.

If you have a history of filing claims, you could see your premiums go up. The best way to get cheap food vendor insurance is to operate a safe and healthy business.

Why FLIP for the Best Food Vendor Insurance?

A+ Rated Coverage

Customizable Policy

Monthly and Yearly Payment Options

Free & Unlimited Additional Insureds

24/7 Online Access

Instant Certificate of Insurance

Coverage Details Limits

General Liability Aggregate Limit

$2,000,000

Products – Completed Operations Aggregate Limit

$2,000,000

Personal and Advertising Injury Limit

$1,000,000

General Each Occurrence Limit

$1,000,000

Damage to Premises Rented to You Limit (Any One Premises)

$300,000

Liability Deductible

NO DEDUCTIBLE

Business Personal Property / Inland Marine Limit (Any One Article / Aggregate)

$5,000/$10,000

Business Personal Property / Inland Marine Limit (Per Occurrence) – Deductible

$250

Medical Expense Limit

$5,000

How Do I Get a Quote?

Easy! Just follow these four simple steps to get your instant quote from FLIP in 10 minutes or less:

2. Select your business activities

3. Fill out the required information

4. Get your free quote and finish checking out!

FAQs About the Cost of Food Vendor Insurance

What Types of Coverage Are Included in Food Vendor Insurance for $25.92/Month?

FLIP’s basic general liability insurance covers common third-party claims, including:

- Bodily injury

- Property damage

- Product liability

- Personal and advertising injury

- Damage to Premises Rented to You

If you need more coverage for things like business equipment or a food trailer, you can customize your policy with add-ons for an additional cost.

Does Food Vendor Insurance Cover Equipment and Inventory?

The base vendor insurance policy does not cover equipment and inventory. But, you can get tools and equipment coverage as an optional add-on for $8.25 a month, which pays to replace or repair your gear if it’s stolen or damaged.

Can I Just Pay for Temporary or Event-Specific Insurance?

FLIP does not currently offer short-term or event insurance for food vendors. However, you can opt to pay your premium on a monthly basis rather than a single annual payment.

We do offer a 1–3-day liquor liability policy for food vendors who want to serve alcohol at a single event.

Reviewed by: Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.