Snow Cone & Shaved Ice Shack Insurance

Beat the heat of costly claims with insurance for your snow cone business.

Snow Cone Shack Insurance Benefits

Discover the benefits of shave ice insurance and how it can protect your business.

Instant Quote Process

Fill out an application and instantly receive your policy price. Purchase in 10 minutes or less and protect your business with a policy designed just for you.

Licensed Nationwide

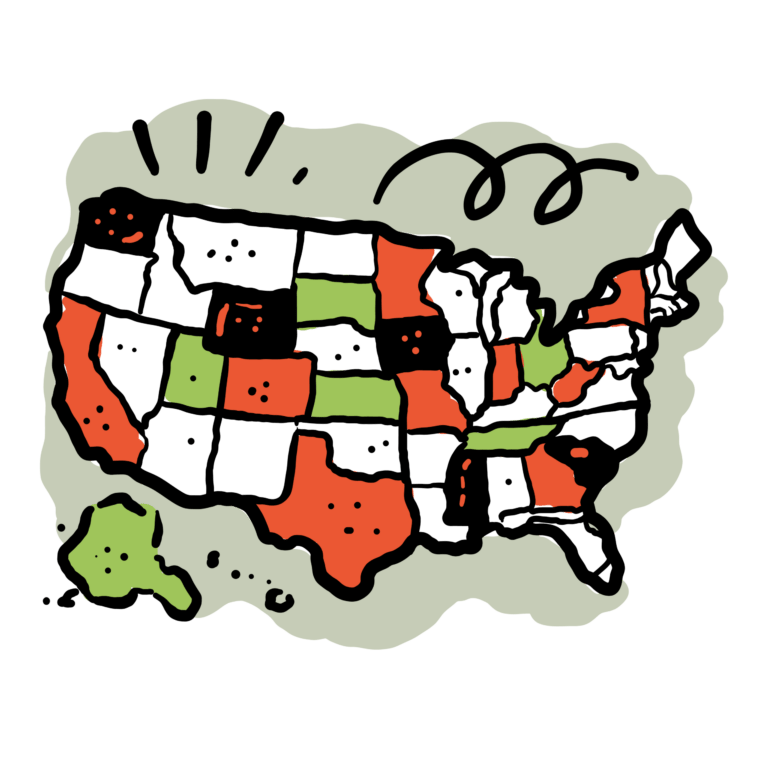

Take your snow cone business wherever you want! We’ll cover it from coast to coast.

Convenient Online Process

Gain instant access to policy documents and certificates of insurance, plus free and unlimited additional insureds.

What Is Snow Cone Shack Insurance?

Snow cone shack insurance is a series of liability coverages that can protect your snow cone business from the costs of third-party injury and property damage claims associated with the industry. Costs can include attorney fees, medical fees, and more.

Small food and drink businesses can be incredibly profitable and successful, especially in the hot summer months, but they are also open to many liability risks that could cripple a small business. FLIP is here to help!

How Much Does Snow Cone Shack Insurance Cost?

You can purchase insurance for your snow cone business from FLIP starting at just $25.92 per month. Included in this cost is a limit of up to $2,000,000 in General and Product Liability coverage, with up to $10,000 in for Inland Marine (tools and equipment) coverage. If you need additional coverage for your business, we offer supplemental policy options and increased limits for an extra cost.

The final cost of your policy can be determined by factors such as:

- The insurance limits you select

- The gross revenue of your business

- The length of your coverage

Do I Need Insurance to Sell Shaved Ice?

Yes! Your snow cone or shaved ice business faces a variety of risks that could end in financially catastrophic claims, such as property damage or a customer contracting food poisoning after eating at your stand.

Snow cone stand insurance can shield your business from expensive costs you would otherwise have to pay for out of pocket. With FLIP, you can purchase coverage in 10 minutes or less with our painless online checkout process and continue operating your stand with the peace of mind that comes from being insured.

Does FLIP Provide Coverage for My Trailer?

If you use a detached trailer as part of your snow cone business operations, then you need a Trailer Endorsement. Most general liability policies do not include incidents that occur in, on, or around your food trailer. However, with FLIP’s Trailer Endorsement, you get coverage for those exclusions so you don’t have to leave part of your work station uninsured.

It is important to note that the Trailer Endorsement only covers liability incidents in, on, or around the trailer when the trailer is detached from your towing vehicle and parked on a rented premise. Make sure your vehicle’s auto policy covers the trailer when it is attached to a vehicle; some auto policies may exclude trailers that have license plates or vehicle identification numbers (VIN).

Let’s Talk Numbers For Snow Cone Shack Insurance

Insurance Coverage Details for Mobile Snow Cone and Shaved Ice Businesses

General Liability

Aggregate Limit: $2,000,000

General Liability insurance can protect your business from paying for third-party bodily injury and property damage claims, which are the most common types of claims. This can also protect against claims regarding products-completed operations, personal and advertising injury, and more.

Product Liability

Aggregate Limit: $2,000,000

As a food-related business you are vulnerable to customers accidentally getting sick from the food you served them. Product Liability insurance can protect you from paying out of pocket for claims that your food made a customer ill.

Inland Marine (Tools and Equipment)

Aggregate Limit: $10,000

Protect your business from the cost of repairing or replacing damaged equipment. FLIP offers increased coverage limits for inland marine based on your business’ insurance needs.

Damage to Premises Rented

Aggregate Limit: $300,000

Protect your business from the cost of claims arising from damages to rented spaces. This includes an event booth or commercial kitchen.

What Our Customers Are Saying

Here's what other people have to say about their experience from over 312+ available reviews.

Coverage Details Limits

General Liability Aggregate Limit

$2,000,000

Products – Completed Operations Aggregate Limit

$2,000,000

Personal and Advertising Injury Limit

$1,000,000

General Each Occurrence Limit

$1,000,000

Damage to Premises Rented to You Limit (Any One Premises)

$300,000

Liability Deductible

NO DEDUCTIBLE

Inland Marine Limit (Any One Article / Aggregate)

$5,000/$10,000

Inland Marine Limit (Per Occurrence) – Deductible

$250

Medical Expense Limit

$5,000