FLIP + Liquor Liability Insurance Partnerships

Get your vendors the top-shelf alcohol insurance they need with Food Liability Insurance Program (FLIP), now available for bartenders, caterers, and more!

- Protects you from mistakes your vendors make

- A+ rated coverage

- Automatically adds you as an additional insured

- Manage and access all your vendors’ COIs in one place

Premium Alcohol Liability Coverage for Your Vendors

Your vendors need liquor liability insurance if they serve alcohol on your premises. Even though you have your own insurance, if your vendors are uninsured you could pay for their accidents.

That’s why FLIP makes it easy to get your vendors the affordable, A+ rated coverage they need, all in one convenient place.

Plus, you’re automatically added to your vendors’ policies as an additional insured.

Everyone benefits when your vendors are insured. Partner with FLIP and take the headache out of managing their coverage!

Who Can Be a Partner?

Event Venue Owners

Catering Hall Owners

Wedding Venue Owners

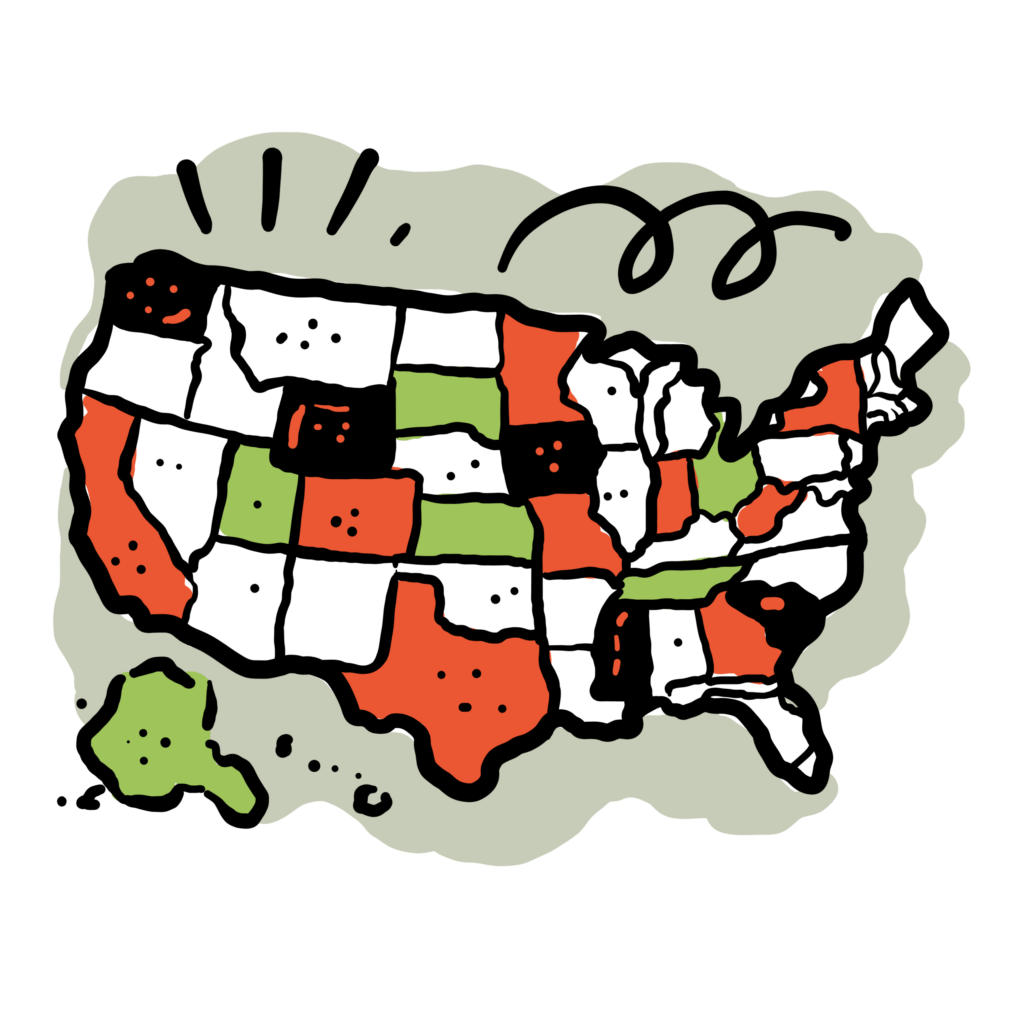

States We Cover

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Benefits of a FLIP Insurance Partnership for Liquor Liability

Short-term and event policies

Automatic additional insured status

Add endorsements to vendors’ policies with help from our team

Monthly or annual payments

View and download Certificates of Insurance (COI) online

Exceptional customer service from licensed agents

Free insurance management software with purchase

Bundle liquor liability and general liability insurance

Manage vendor policies through one insurance company

Platinum

General Liability + Liquor Liability Annual Policy

For caterers, food trucks, concessionaires, private chefs. Best for businesses who serve alcohol and food. General Liability policy included.

Starts at $37.75/Month

Gold

Liquor Liability Annual Policy

For caterers, food trucks, concessionaires, private chefs, bartenders. Best for businesses who need long-term alcohol coverage. General Liability policy required.

Starts at $25/Month

Silver

General Liability + Liquor Liability Event Policy

For caterers, food trucks, concessionaires, private chefs, bartenders. Best for businesses who need short-term alcohol coverage. General Liability policy included.

Starts at $150/Event

Bronze

Liquor Liability Event Policy

For caterers, food trucks, concessionaires, private chefs, bartenders. Best for businesses who need short-term alcohol coverage. General Liability policy required.

Starts at $100/Event

FAQs About Partnering With FLIP for Liquor Liability

When Would I Need a Liquor Insurance Partnership?

If you have alcohol-serving businesses operating on your premises, you need an alcohol insurance partnership.

Serving alcohol carries many risks. If one of your vendors overserves a patron who drives intoxicated and causes an accident, you could be held financially responsible alongside the vendor.

Does FLIP Offer a Host Liquor Liability Partnership?

No, FLIP does not sell host liquor liability insurance. This partnership is intended for event managers, venue owners, and festival organizers whose vendors sell, serve, or provide alcohol as part of their regular business operations and would not be covered by a host liquor policy.

Where Do I Send My Vendors to Get Insurance?

You will receive a link to a custom webpage made just for your event or organization when partnering with us. Share this link with your vendors so they can purchase a policy.

How Do I Get Listed as an Additional Insured on My Vendors’ Policies?

When your vendors purchase a policy through your custom webpage, you will automatically have additional insured status.

After purchase, you automatically receive a copy of their Certificate of Insurance (COI) in your dashboard and by email.

How Do I Get a Copy of My Vendor’s Certificate of Insurance (COI)?

- Share the link to your custom webpage with your vendors.

- Encourage your vendors to purchase a policy through the link on your webpage.

After their purchase, you automatically receive a copy of their Certificate of Insurance (COI) in your dashboard. You also receive an updated version when your vendor renews their policy.

What Additional Partnerships Are Available?

FLIP’s sister companies provide additional partnership opportunities:

Have Questions About FLIP Insurance Partnerships?

Reviewed by: Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.