Property Damage

What Is Property Damage Liability?

Property damage liability covers third-party property damage related to your business operations. This coverage is included in a general liability policy.

Suppose your business is responsible for damaging the property of a third party, such as a venue or fairgrounds. In that case, your insurance can cover the cost of repairing or replacing it.

You cannot make a property damage claim for your personal or business property. This type of coverage only applies to third parties.

Bodily Injury and Property Damage Liability

Bodily injury and property damage are included in Section I of our standard general liability insurance. The Food Liability Insurance Program (FLIP) policy states that we will pay for damages resulting from third-party bodily injury or property damage if you are found legally responsible.

What Does Property Damage Liability Cover?

When a piece of property is damaged to the point that the owner can no longer use it as intended, your policy can cover the cost to repair or replace it.

For example, if your food truck’s generator blows up and causes a fire in a neighboring building or booth, the property damage section of the general liability policy should respond.

What Does Property Damage Liability Not Cover?

Your general liability policy will not cover property damage to the following:

- Electronic data

- Property you own, rent, or occupy

- Property you sell, give away, or abandon

- Property loaned to you

- Personal property in your care, custody, or control

Your policy includes coverage for Damages to Premises Rented to You, which covers property you rent in a limited capacity. Make sure to review your policy for your specific coverage.

How Much Property Damage Liability Do I Need?

The amount of property damage coverage your business needs depends on a few factors, including:

- How much you can afford to pay out of pocket

- The personal and business assets you need to protect

- Your annual budget for insurance coverage

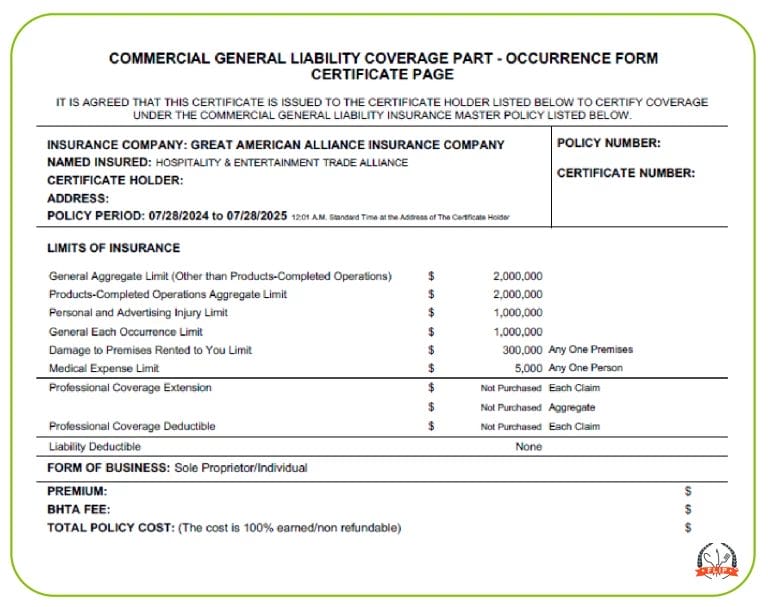

FLIP’s general liability policy provides a $1,000,000 limit for third-party property damage claims. You can add excess liability insurance if you require higher limits to meet your business needs.

What Are Common Property Damage Claims Examples?

Property damage liability claims come in many forms. Here are a few examples from real FLIP customers:

- At a farmers market, a gust of wind blew a policyholder’s tent into a nearby vehicle, resulting in over $3,000 in repairs.

- A fire broke out on an insured’s food trailer, damaging the venue’s porta-potties. The property owner sued the business for $3,000 to replace them.

- Oil from a policyholder’s fryer splattered on the sidewalk of a venue. The property owner charged almost $400 to clean the mess.

All of these property damage claims were covered by insurance, protecting each business owner from being stuck with the bill.

What Is the Property Damage Insurance Claims Process?

If you need to make a property damage claim, you can start the process online via your dashboard:

- Log in to your user dashboard

- Click “File A Claim”

- Add all the necessary information

- A claims adjustor will contact you and the claim will be taken care of

An adjuster will typically contact you within 48 hours to discuss your claim further and answer any questions.

Property Damage Example

Read More

- See also: Claim

- See also: Deductible

- See also: Bodily Injury

- See also: Liability

- FLIP’s Insurance Coverage Details