Excess Liability

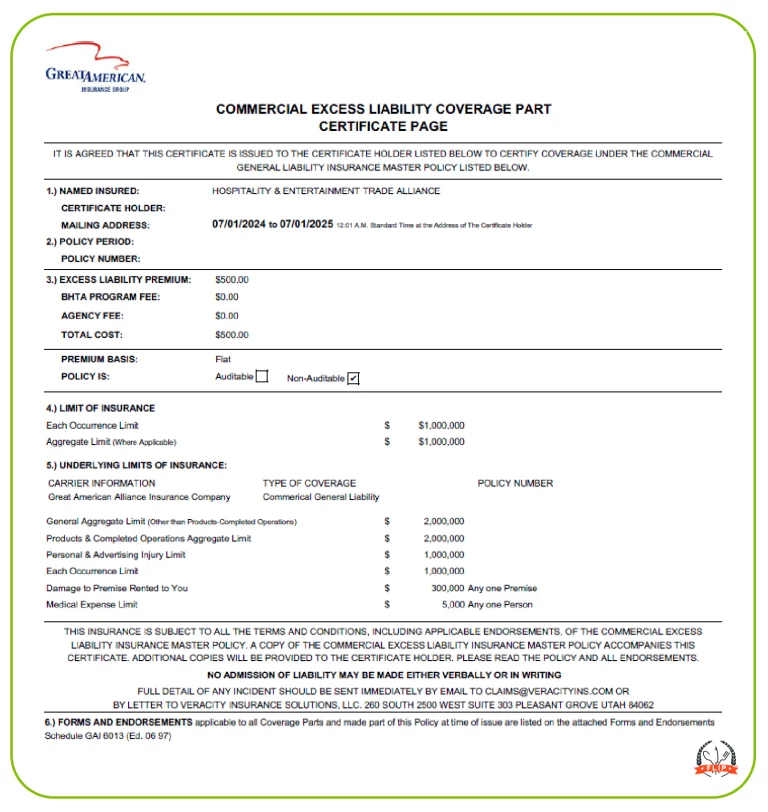

What Is Excess Liability Coverage?

Excess liability insurance increases your general liability policy limits. You may want to add this coverage if your business has a higher financial risk, or if a venue or event coordinator requires a higher limit than your existing policy provides.

Commercial excess liability comes in layers of $1,000,000, and you can purchase layers from multiple insurance companies if necessary.

For example, the base policy provides a $1,000,000 limit per occurrence. Let’s say the venue you’re partnering with requires a $4,000,000 liability limit. To meet this requirement, you would need to purchase three $1,000,000 layers to get $3,000,000 in excess liability coverage.

Combined with the base general liability policy, you now have a total liability limit of $4,000,000.

Note: You must have an established and active general liability policy to purchase excess liability coverage. Increased limits do not apply to optional coverages, such as Inland Marine (Tools and Equipment) or Professional Liability.

What Does Excess Liability Insurance Cover?

Most excess liability policies are written on a “follow form” basis, meaning that the coverage is similar to your general liability policy. In other words, the excess liability policy is subject to the same coverage terms and conditions as the base general liability policy.

Do I Need Excess Liability?

You will need to add excess liability to your policy if a contract requires you to carry more than the $2,000,000 in liability insurance included in FLIP’s base policy.

Even if you’re not required to have excess liability coverage, it’s a wise investment if your business is at risk for claims exceeding your base policy limits. The cost of excess liability is minimal compared to your potential out-of-pocket expenses in the event of third-party bodily injury or property damage.

How Do I Add Excess Liability to My Insurance Policy?

FLIP manages excess liability insurance on a case-by-case basis to ensure our customers get the coverage they need. If you need to increase your policy limits, call our expert agents at 1.844.520.6992 to add excess liability to your existing insurance policy.

Excess Liability Example