Assault and Battery

What Is Assault and Battery?

Assault and battery is the crime of threatening a person and making physical contact with them.

Difference Between Assault and Battery

Assault is intentionally or recklessly causing someone to reasonably fear harm or violence, and battery is intentionally or recklessly harming someone.

Physical contact does not have to occur for an act to be considered assault.

Examples of assault:

- Making credible threats to hurt the victim

- Pointing a weapon at the victim

- Trying to spit on the victim

- Attempting to kick, shove, hit, or push the victim

Unlike assault, physical contact is necessary for an act to be considered battery. It doesn’t matter if the victim was injured as a result.

Examples of battery:

- Hitting the victim

- Harming the victim with a weapon

- Touching the victim in an unwanted way, even if it doesn’t injure them

What Does Assault and Battery Insurance Cover?

Assault and battery coverage insures for bodily injury or property damage claims arising from assault or battery whether caused by the insured, their employees, or patrons.

Assault and battery excludes any sexual assault.

Who Needs Assault and Battery Coverage?

Anyone who feels they have an exposure to assault and battery claims due to the nature of their business should consider this type of insurance.

For food and beverage businesses that serve alcohol, assault and battery coverage is a must-have.

Whether you’re a mobile bartender or you have a caterer that offers alcohol—or anything in between—selling alcohol can be profitable for your business and appealing to customers. However, there’s always a chance that people could drink beyond their limits and cause physical harm to others.

As the business that sold or provided them with that alcohol, you could be held liable to pay for any damages that result from an alcohol-related assault and/or battery charge. To shield yourself from having to pay thousands of dollars out of pocket for a claim like this, you need to add assault and battery coverage for your FLIP liquor liability insurance policy.

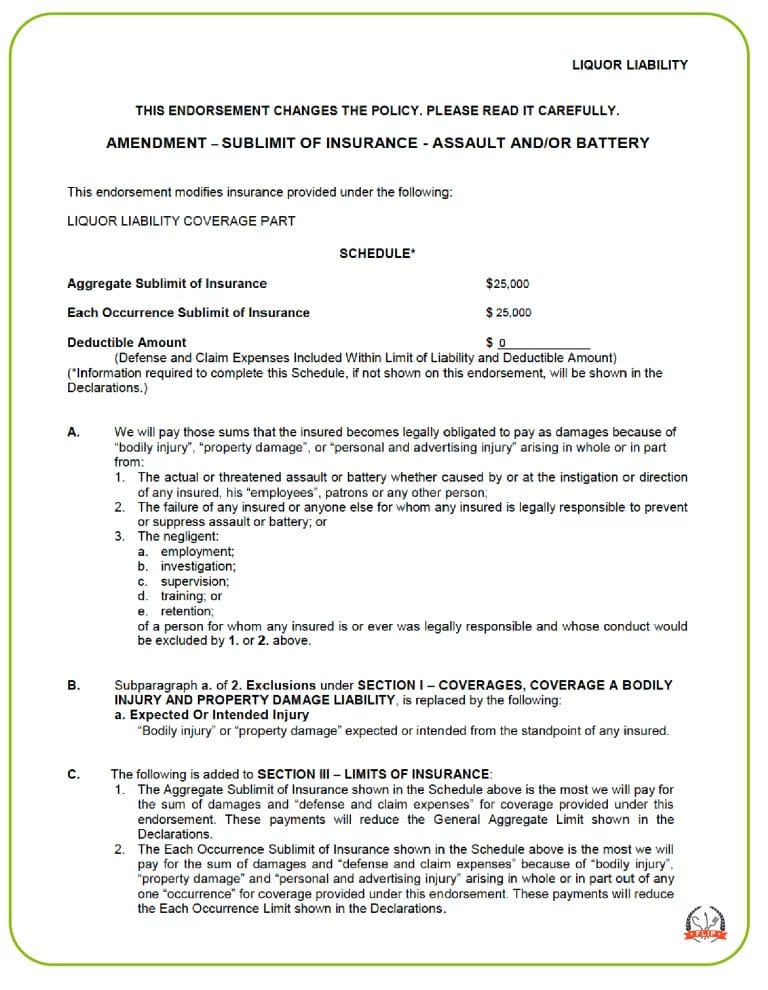

Assault and Battery Sample

How Do I Get Assault and Battery Coverage From FLIP?

Assault and battery coverage is unavailable on FLIP’s general liability policy, but you can add this coverage to the annual liquor liability policy for an additional premium. However, it is not automatically included in the liquor liability policy.

How to Add Assault and Battery Coverage to Your FLIP Policy

As you complete the liquor liability application, you can choose to add assault and battery coverage. It is important to note that the limit offered for assault and battery coverage is $25,000.

If you need to add this coverage after purchasing your policy, you can add the option through your user portal or call customer service (844.520.6992).

Cost of Assault and Battery Coverage From FLIP

The cost to add this coverage to your FLIP liquor liability policy is $106 per year for $25,000 coverage.