Additional Insured

What Is an Additional Insured?

An additional insured is an individual or business entity that is added to your general liability insurance policy. The additional insured receives protection from your policy if they are sued because of your negligence.

Most additional insureds are added to fulfill contractual requirements. Additional insureds can be landlords, event organizers, vendors, resellers, or other third parties who need protection from the named insured’s liability.

Named Insured vs. Additional Insured

The named insured is otherwise known as the policyholder or primary insured. Their name is located on the declaration page and they own the policy. The named insured has the authority to make changes to the policy and is responsible for premium payments.

The difference between a named insured and an additional insured is that an additional insured does not own the policy and is not considered a policyholder. The additional insured does not have the authority to make changes to the policy and is not responsible for paying premiums.

Who Should Be Listed as an Additional Insured?

You should only list an individual or entity that requests additional insured status on your policy. This usually happens when you are required by contract to name them as an additional insured.

Examples of common additional insureds include:

- Landlords

- Venues

- Farmers markets

- Retailers or distributors

- Kitchen owners

- Events/shows

Who Should Not Be Listed as an Additional Insured?

You or any entity you own should not be listed as an additional insured. This will not properly insure or protect your company.

What Does an Additional Insured Cover?

If the additional insured is brought into a lawsuit or claim because of your negligence, your insurance policy will defend them and pay any judgments that are brought against them.

For example, imagine you’re attending a farmers market and someone gets food poisoning from your product. The injured person can sue you and the farmers market. If the farmers market is an additional insured on your policy and is being brought into a suit because you made someone sick, your policy will protect you and the farmers market.

How Much Does It Cost to Add an Additional Insured?

As a FLIP customer, there is no additional cost to add an additional insured to your policy.

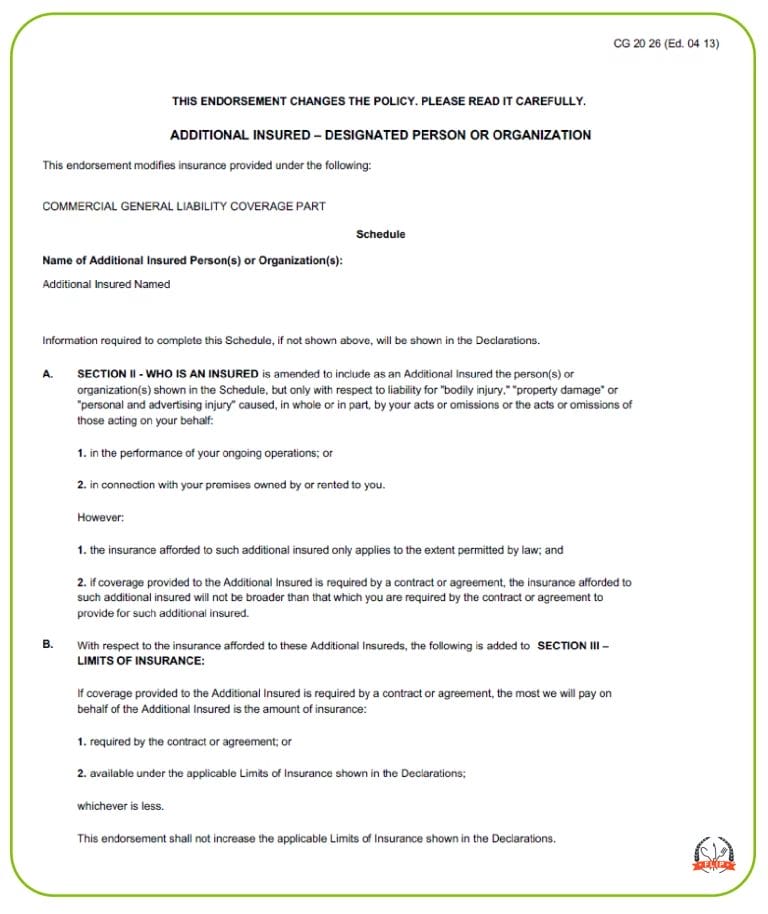

Additional Insured Endorsement Sample

Read More

- How to Add Additional Insureds to Your FLIP Policy

- See also: Primary and Noncontributory

- See also: Insured

- See also: Certificate of Insurance (COI)