Food Truck Statistics

Food trucks are the shining stars of the fast-casual food sector, bridging the gap between quality eats and convenience.

We love celebrating this booming industry, so we surveyed our food truck policyholders. They gave us all the details about their menus, customer habits, profits and expenditures, and more.

Here are some of our key food truck industry statistics takeaways:

- 5 to 8 PM is the busiest time of day for most food truck owners, with 63.6% of operators reporting evenings as their peak hours.

- 40% of food truck owners describe their business as moderately profitable (generating a steady profit without any significant increases).

- 48.3% of food truck operators use the cost-plus strategy for pricing their menu items.

- 86.9% of food truck operators use Facebook to promote their business, making it the most popular social media platform for this industry.

Read on to satisfy your appetite for food truck facts and insights.

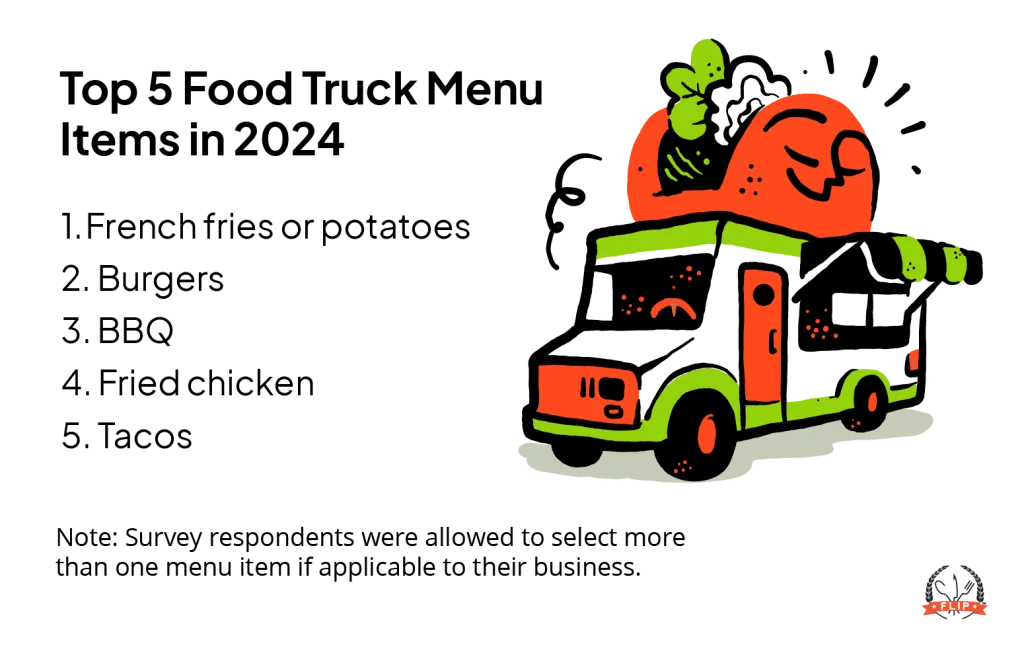

Top Food Truck Menu Items

As of 2024, the most popular food truck menu item is French fries or potatoes, with 21% of survey respondents including them in their offerings.

Other top-selling menu items:

- 19.2% sell burgers

- 15.3% sell BBQ

- 11.7% sell fried chicken

- 10.2% sell tacos

Check out our complete list of the top food truck menu items in the U.S. in 2024!

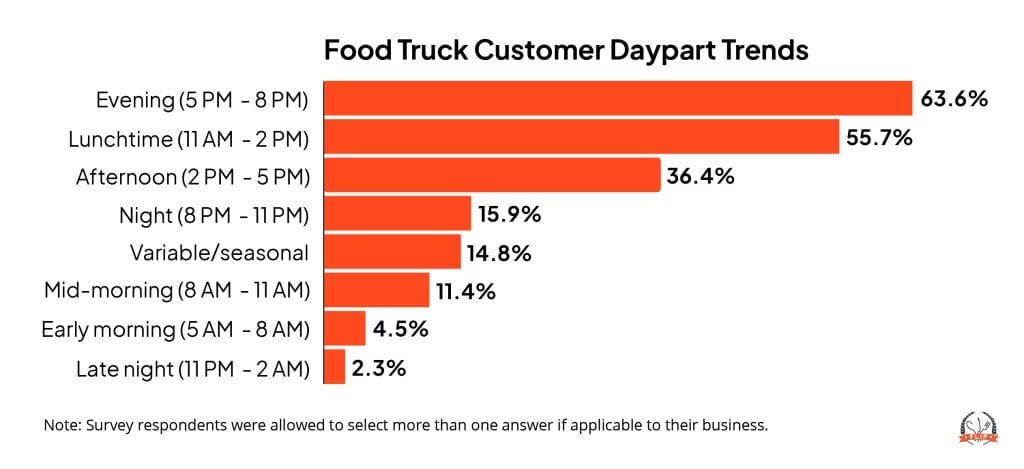

Food Truck Customer Insights

63.6% of food truck operators surveyed reported the evening (5 – 8 PM) as their peak business hours.

Other reported daypart trends:

- Lunchtime (11 AM – 2 PM) is the second busiest time of day for food trucks, according to 55.7% of respondents.

- The slowest time of day is late night (11 PM – 2 AM), with only 2.3% of respondents reporting this period as peak business hours.

- 14.8% of food truck operators experience variable or seasonal peak hours, with their busiest times changing throughout the year or being affected by location.

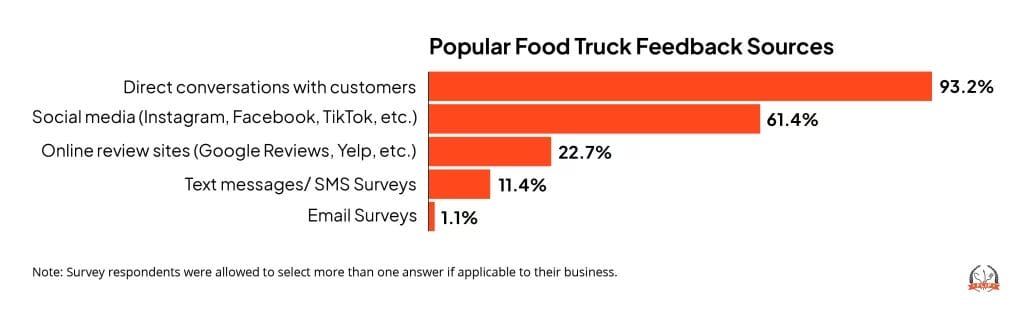

Food truck operators rely on direct conversations with customers to get feedback on their business, according to 93.2% of respondents.

Other food truck owners report gathering feedback from these sources:

- 61.4% use social media

- 22.7% use online review sites like Google Reviews and Yelp

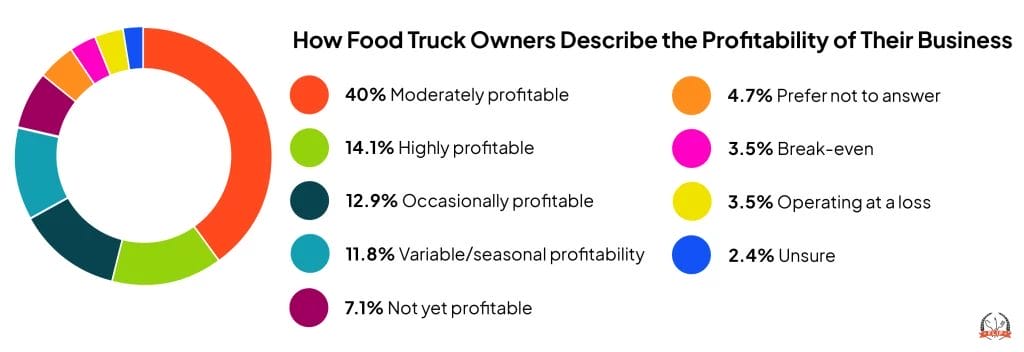

Average Food Truck Profits

- 40% of business owners describe their operations as moderately profitable, or maintaining a steady stream of income without any major spikes in revenue.

- 14.1% consider their food truck to be highly profitable.

- 11.8% of food truck owners report variably or seasonally profitable.

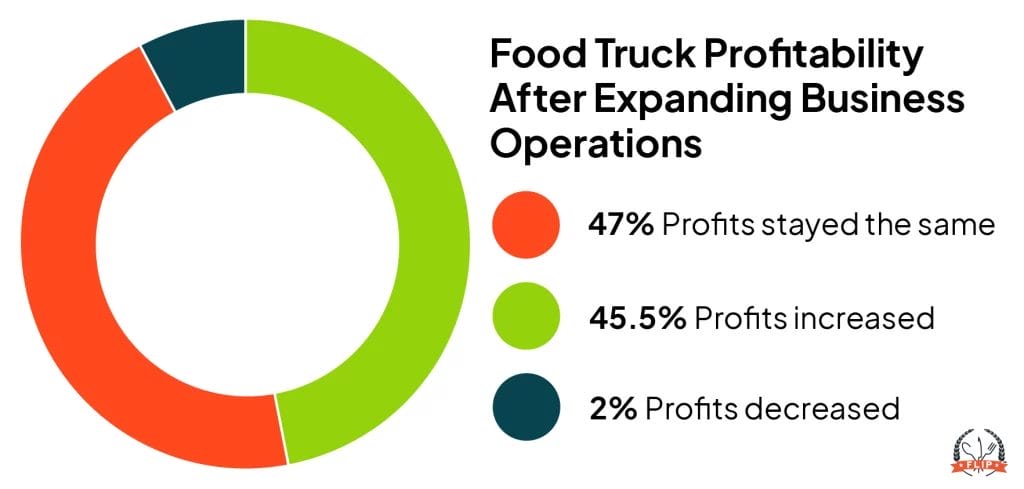

When asked how expanding their business (e.g. adding more trucks, including new menu options, etc.) affected profitability, 47% of respondents said revenue stayed the same.

While most food trucks didn’t experience a change in profitability, 45.5% reported an increase in profits after expanding their business.

Only 7.6% of respondents experienced decreased profitability after adding on to their business.

Food Truck Pricing

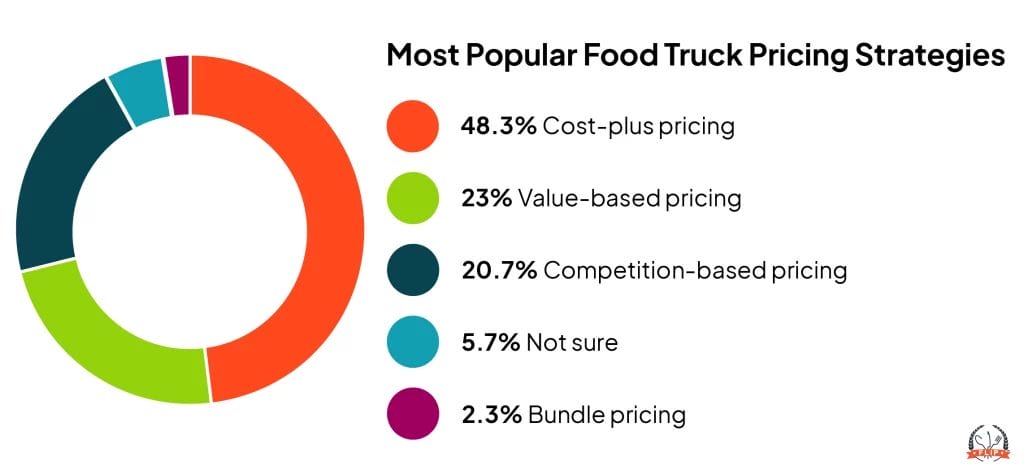

The lion’s share of food truck businesses (48.3%) use the cost-plus strategy for pricing their menu items.

Value-based pricing is the second-most popular strategy, with 23% of food truck operators using this to determine prices.

20.7% reported using competition-based pricing as their primary strategy, putting it closely behind value-based pricing in terms of popularity.

Learn how to price your menu items and ensure you’re balancing revenue with expenditures and making the profits you need to stay in business.

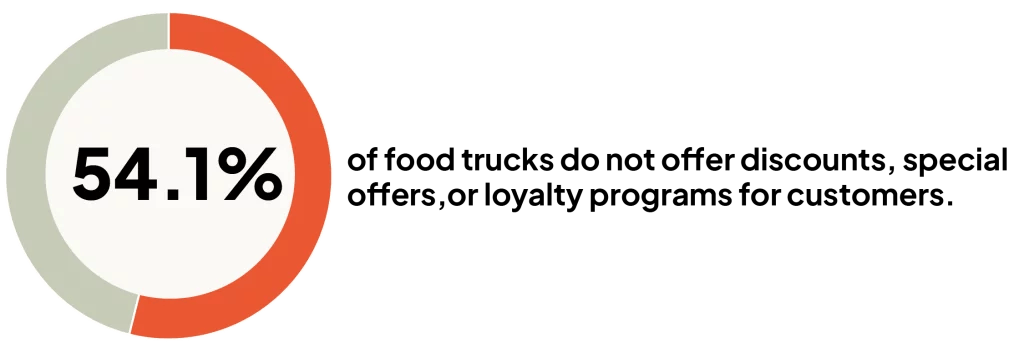

Food truck operators are divided when it comes to offering discounts, specialty offers, or creating loyalty programs for their customers.

45.9% of survey respondents said they do offer discounts or special offers, while the majority (54.1%) do not.

The Costs to Run a Food Truck

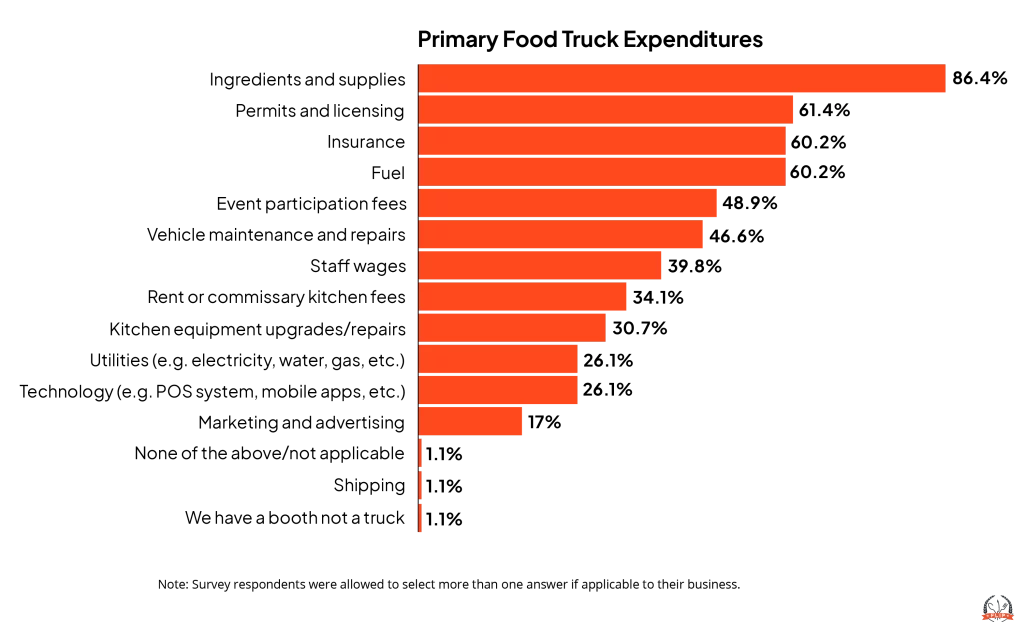

- 86.4% of food truck owners say ingredients and supplies are the primary cost associated with operating a food truck.

- Permits and licensing (61.4%) are the next biggest expenditure.

- Fuel (60.2%) and vehicle maintenance/repair (46.6%) also make up a bulk of expenses for food truck operators.

- 26.1% say utilities are a primary expense for their food truck business.

- The majority of food truck owners do not list marketing and advertising among their greatest expenses — only 17% of respondents classify it as a major expenditure.

Since fuel and vehicle maintenance/repair make up a bulk of expenses for food truck operators, it’s crucial to pick the best vehicle for your food truck that won’t break the bank in terms of fuel efficiency and quality.

Food Truck Festivals and Events

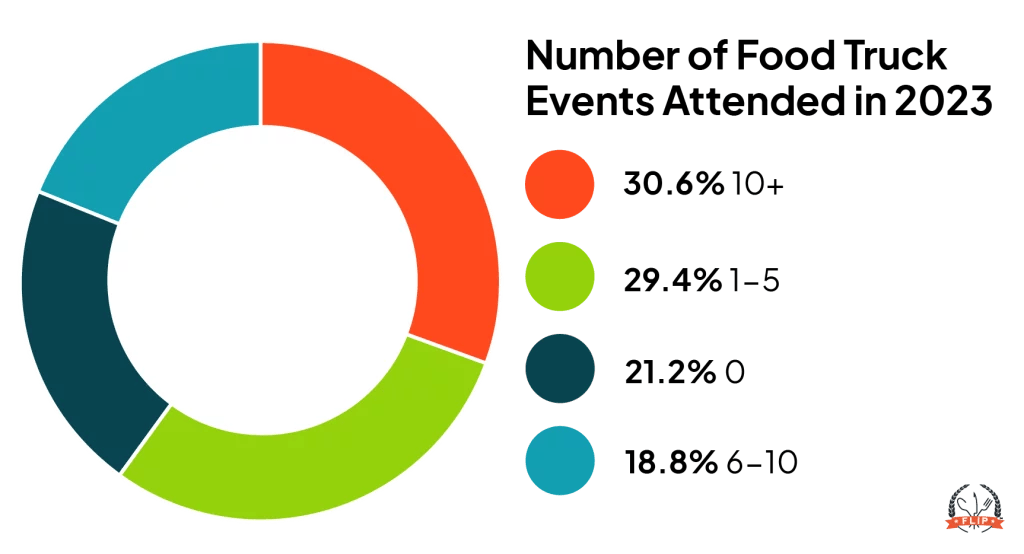

- Food truck operators remain big participants in festivals and rallies, with 30.6% of them attending 10 or more events in 2023.

- Nearly as many (29.4%) reported only participating in 1–5 events last year.

- 21.2% — more than one in five — didn’t participate in any events

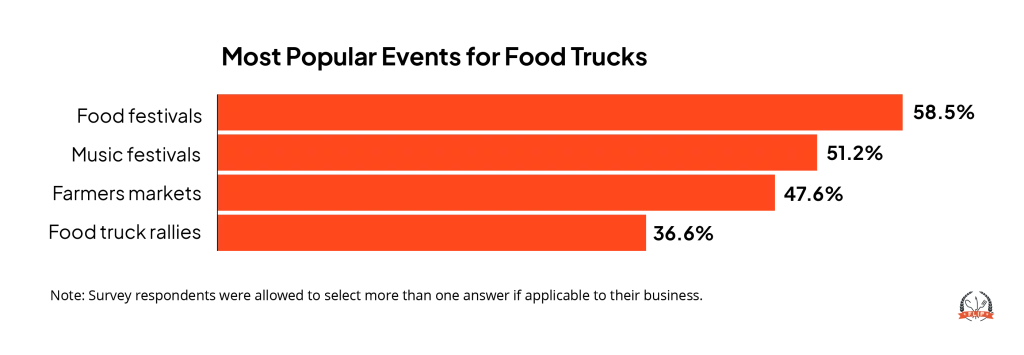

- 58.5% of respondents prefer participating in food festivals.

- 51.2% of food truck owners vend at music festivals, making them the second-most popular event for them to participate in.

- Farmers markets and food truck rallies are also popular, according to 47.6% and 36.6% of respondents, respectively.

If you’re interested in participating in events like these, discover 6 ways to get your food truck into festivals this year and expand your vending repertoire!

Preferred Technology for Food Truck Owners

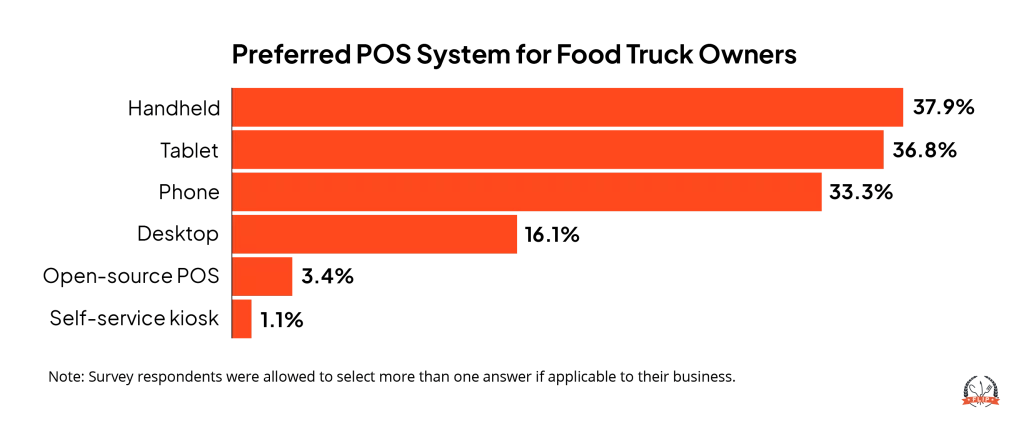

For point-of-sale (POS) systems, here’s what food truck owners are using:

- Handheld is the most popular with food truck operators: 37.9% said they use a handheld system to process transactions.

- 36.8% use a tablet, followed closely by smartphones at 33.3%.

- Despite the rise in handheld devices and tablets, 16.1% of food trucks use a desktop computer POS system.

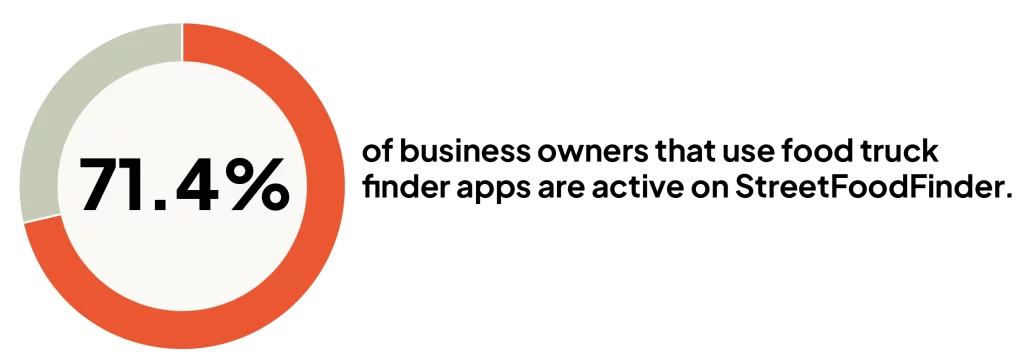

Apps like Truckster and StreetFoodFinder allow customers to see where food trucks are operating, but 80.2% of food truck owners surveyed said they do not have a presence on these platforms.

- Of the 19.8% of food truck owners who do use food truck finder apps, the overwhelming majority have a presence of StreetFoodFinder (71.4%).

- Mobile Nom is the next most popular food truck finder app, with 14.3% of respondents saying they’re active on this platform.

- Truckster, Truckily, and TruckFindr are the least popular, each used by 7.1% of food truck owners surveyed.

Food Truck Marketing

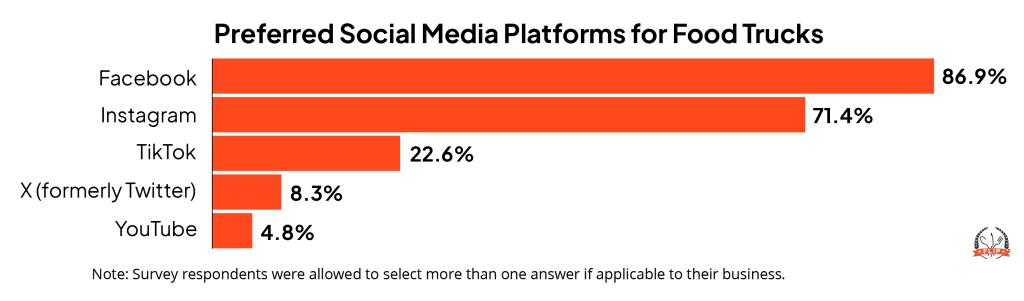

- When it comes to preferred social media platforms for food trucks, Facebook takes the lead. 86.9% use it to promote their food truck business.

- Instagram, which is owned by Facebook, is the next most popular platform for food trucks according to 71.4% of people surveyed.

- Despite its growing popularity worldwide, only 22.6% of food truck owners use TikTok to promote their business.

Learn how to promote your food truck on Instagram while still connecting with your Facebook audience and discover why Instagram is such a great platform for food businesses.

Food Truck Insurance Claims

In 2023, FLIP received 53 insurance claims from food truck insurance policyholders.

Out of all the claims filed with FLIP in 2023, the most common general liability claims were customer slip-and-fall injuries. One such claim involved a customer slipping and falling on a wet surface outside the policyholder’s leased premises. FLIP covered this $6,598 claim.

As for tools and equipment claims, weather damage and stolen gear — particularly generators — top the list.

Generators are often targeted by thieves because some are worth hundreds and sometimes even thousands of dollars. One policyholder had both of their generators stolen for a total of $1,154, which FLIP was able to cover for them.

Make sure your food truck is protected in the event of incidents like these with affordable, customizable food truck insurance from FLIP!