Last Updated: February 14, 2025 by Alex Hastings

Getting liability insurance for your food business is as critical to your success as building your brand and serving your customers a high-quality product. But if you aren’t sure what food and beverage insurance is, it’s hard to know if you’re getting the coverage you need for a fair price.

A foundational understanding is the key to getting coverage with confidence. To make this important decision a little less stressful, Food Liability Insurance Program (FLIP) is here to share answers to the most common questions in this quick guide to food liability insurance.

What Is Food Liability Insurance?

Food and beverage insurance is a combination of coverages designed to protect your business from the cost of common accidents that can temporarily (or sometimes permanently) bring your operations to a halt.

The average food business claim cost $3,385 in 2024. With insurance, you have a financial safety net to prevent you from paying that cost out of pocket.

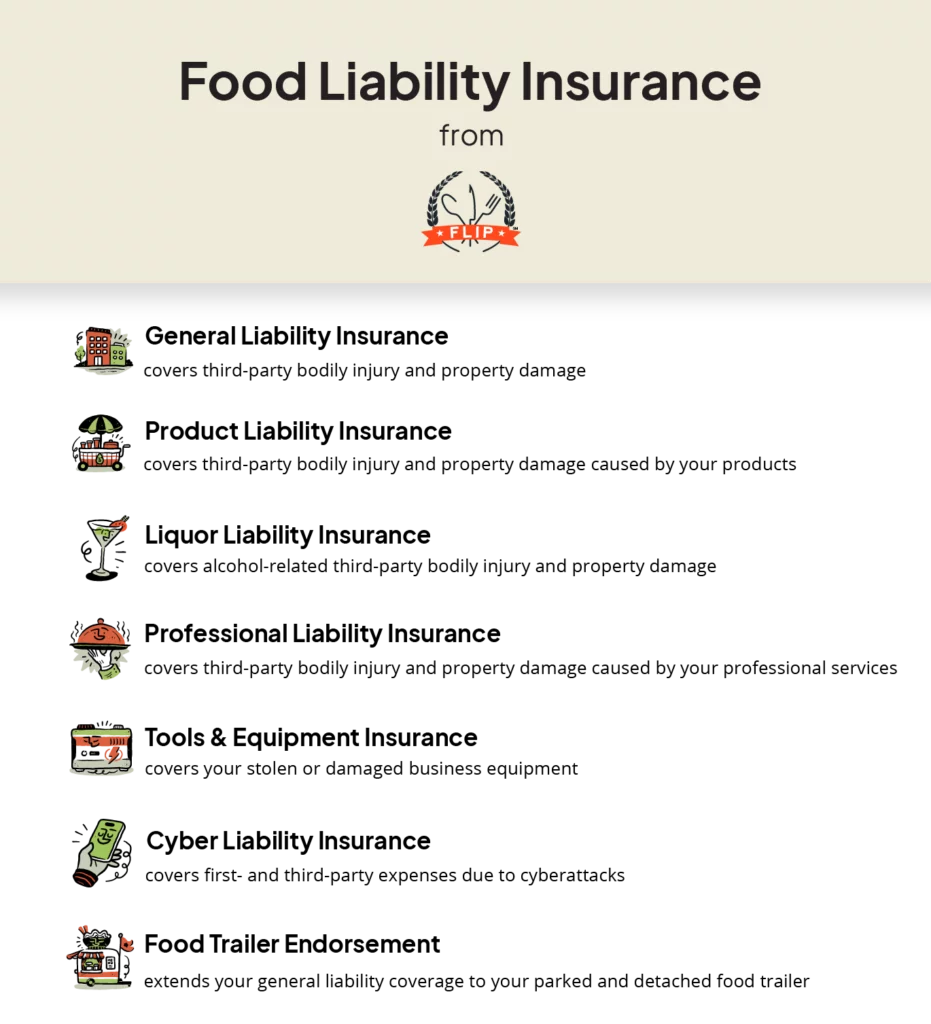

Food liability policies typically include a combination of the following coverages:

- General liability (included in base FLIP policy)

- Product liability (included in base FLIP policy)

- Liquor liability (requires an existing general liability policy before purchase)

- Professional liability

- Cyber liability

- Tools and equipment coverage (inland marine)

General Liability Insurance

General liability provides the foundation for food business insurance. It’s designed to cover third-party bodily injury and property damage claims, such as food poisoning or slip-and-fall accidents. In other words, general liability insurance can pay for damages to “the other guy,” not you.

General liability also provides coverage for damages made to a premises you rent. For example, one FLIP policyholder caused a fire in a commercial kitchen they rented. The kitchen manager filed a claim against them for $61,323 in damages, which FLIP covered.

The final component of our base policy is personal and advertising injury. This coverage applies to claims involving the way you advertise your products and/or services. This includes accusations of libel, slander, defamation, or copyright infringement.

Product Liability Insurance

Product liability coverage also responds to third-party bodily injury and property damage incidents, but only when caused by one of your food or beverage products.

One policyholder was sued after a customer bit into a sandwich and broke a tooth on an olive pit. FLIP covered this $6,575 claim.

Liquor Liability Insurance

If you sell or serve alcohol as part of your regular business operations, you need this coverage. General liability policies exclude alcohol-related claims, but you can be held liable to pay for third-party injuries and property damage caused by an intoxicated customer.

This happened to a FLIP policyholder who accidentally overserved a guest at a party they were bartending. That guest caused a car accident on their way home from the party and injured a passenger in another vehicle. The bartender was held liable for $1,018,500.

Professional Liability Insurance

Sometimes referred to as errors and omissions coverage, professional liability insurance covers third-party bodily injury and property damage claims related to your professional services.

A chef insured by FLIP accidentally damaged the table in a brewery while teaching a cooking class. Because they had professional liability insurance, this $500 claim was covered by their policy.

Cyber Liability Insurance

Over half of all cybercrimes target small or mid-sized businesses. Cyber liability insurance responds to claims stemming from phishing, hacking, ransomware, and data breaches that affect your business.

These attacks can be financially crippling, as one New York restaurant learned. A cybercriminal tricked them out of $45,000 with a payroll scam, causing them to shut their doors for good.

Tools & Equipment (Inland Marine)

You can’t run your business without your equipment, which is why tools and equipment coverage is so essential.

A FLIP policyholder in Tennessee had their generator stolen while cleaning out their food truck. They would’ve had to pay $1,350 to replace the generator out of pocket, but because they had tools and equipment insurance, this cost was fully covered.

What Costs Does Food Liability Insurance Cover?

A food and beverage insurance policy can cover a variety of different expenses you might face when hit with a claim. This includes:

- Legal costs you accrue while defending your business from a lawsuit (attorney fees and settlement costs)

- Third-party medical expenses due to food poisoning or other bodily injuries (hospital stays, treatments, surgeries, etc.)

- The cost of repairing or replacing third-party property that you damaged while operating your business

- First- and third-party related to recovering stolen data, such as credit monitoring (only available with cyber liability coverage)

- Replacing or repairing your damaged or stolen business equipment (only available with tools and equipment coverage)

Who Needs Food Business Liability Insurance?

If you own a food or beverage business, you need food liability insurance. From farmers market vendors to mobile bartenders, every business faces liability risks.

While not typically required by law, this coverage is an essential investment in your business’ financial strength. Mitigating risks by taking safety precautions is a crucial part of avoiding accidents, but they can still happen to even the most prepared businesses.

Having the right coverage prevents you from paying thousands of dollars for unforeseen incidents that a liability insurance policy would have covered.

How Much Does Food Liability Insurance Cost?

The cost of food liability insurance from FLIP can be as low as $25.92 per month.

There are a few factors that can increase the exact amount you pay, including:

- Add-on coverages: With FLIP, you can add extra coverage to your policy and customize it to suit your needs, such as cyber liability, tools and equipment, and the food trailer endorsement.

- Your claims history: If your business has had previous insurance claims, you may pay a slightly higher premium to offset this risk.

- Your business’ gross annual revenue: Businesses that earn more money per year have more assets to cover and might need higher limits than smaller businesses.

89% of our customers pay as little as $26 per month to get the coverage they need.

Why FLIP Offers the Best Food Liability Insurance

At FLIP, we don’t make you choose between affordability and quality when it comes to coverage. Our mission is to provide A+ rated liability insurance tailored for food businesses. We offer great prices and easy online purchasing to take the stress out of buying insurance.

FLIP is also the exclusive provider of the food trailer endorsement, which extends your general liability coverage to your food trailer. Most general liability policies exclude food trailers, but with FLIP you can operate out of your food trailer knowing you have coverage for common third-party claims.

Come join over 40,000 food and beverage business owners who trust FLIP to protect their operations!

We have had policies with them for probably 11 years and everything has always been so professional, fast, and easy. I would never think of moving to a new carrier.

Shannon O., Hot Day Afternoon BBQ & Catering

See more testimonials from our happy customers and discover what joining FLIP can do for you.

FAQs About Food Business Insurance

How Do I Choose the Right Amount of Coverage for My Food Business?

The amount of coverage you need is directly tied to these factors:

- Business size and revenue: The bigger your business or the more money it makes, the more assets you have to cover. This means you may need higher policy limits than smaller businesses.

- Risk exposure: While all businesses face risks, some face more than others. A baker who sells their goods at farmers markets may be more vulnerable to a slip-and-fall claim than one who exclusively delivers directly to their customers.

- Location: Businesses that operate in a high-traffic or densely populated area often need more coverage due to increased liability risks.

Required limits: Commercial kitchen landlords or venue managers may require you to carry a policy with certain coverage limits to make sure you’re properly prepared in case of an accident.

If you aren’t sure what limits or coverages you need, give us a call at 844.520.6992! Our team of licensed agents is here to help you find exactly what you need — no more, no less.

How Do I File a Claim With FLIP?

- Log in to your user dashboard

- Navigate to “Manage Policies” and select “File a Claim”

- Fill out all necessary fields with detailed information about the incident (time, place, contact information for all parties involved, etc.) and submit

A claims adjuster will contact you afterward and guide you through the rest of the process.

Do I Need Food Liability Insurance for a Small or Home-Based Food Business?

Yes! It doesn’t matter what size your business is or if you operate completely at home — all food and beverage businesses face risks that could lead to expensive accidents.

For instance, you could still be hit with a food poisoning claim if you make baked goods at home, just like a brick-and-mortar bakery would.

Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.

Alex Hastings

Seattle-based copywriter and (WA) licensed insurance agent Alex Hastings leverages her experience as a lover of fast-casual food, baked goods, and iced oat milk lattes. She holds a B.A. in Creative Writing from Western Washington University. Before working at Veracity, she was a retail copywriter at Zulily and an English language teacher in South Korea. Alex is fully trained on FLIP insurance coverages and writes content that connects food and beverage business owners with the policies they need.

Seattle-based copywriter and (WA) licensed insurance agent Alex Hastings leverages her experience as a lover of fast-casual food, baked goods, and iced oat milk lattes. She holds a B.A. in Creative Writing from Western Washington University. Before working at Veracity, she was a retail copywriter at Zulily and an English language teacher in South Korea. Alex is fully trained on FLIP insurance coverages and writes content that connects food and beverage business owners with the policies they need.