Liquor Liability Insurance Cost

Figuring out the cost of liquor liability insurance for your business may seem overwhelming. But we’re here to help by answering your biggest questions and explaining your coverage options.

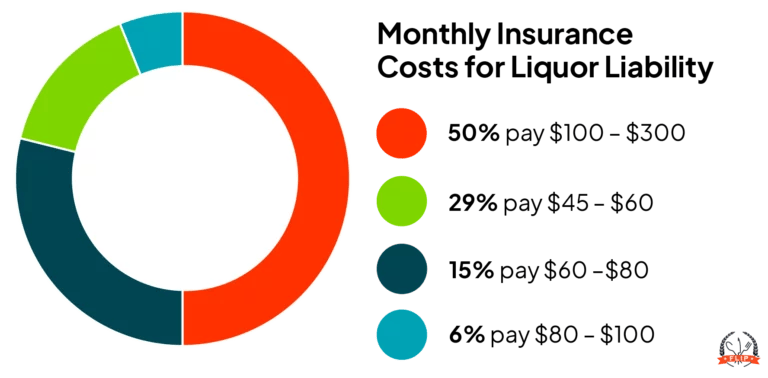

How Much Does Liquor Liability Insurance Cost?

Liquor liability insurance starts as low as $300 per year. If you opt for a comprehensive general and liquor liability policy, it starts at $37.75 per month or $453 annually.

How much you’ll pay depends on where you’re located, how much your business makes, and any additional coverage you select.

How Much Does Liquor Liability Insurance Cost for Weddings and Events?

The cost of short-term liquor liability starts at $100 for a 1–3 day event. Final pricing depends on the state where you operate and the size and length of your event. This coverage is ideal for private event or wedding bartenders who only work at a few events per year.

What Liquor Liability Coverage Options Are There?

What Factors Affect Liquor Liability Insurance Cost?

Several factors influence the final cost of your liquor liability insurance: the type of coverage you select, where you operate, and how much your business earns annually.

Bartenders and alcohol-serving businesses have a few options when selecting coverage. You can purchase a one-time event policy, get an annual policy for just liquor liability insurance, or bundle it with general liability. The more coverage you need, the higher the cost of your insurance will be.

If you opt for bartender insurance that combines general and liquor liability, you automatically get coverage for third-party bodily injuries, property damage, and product liability. This is ideal for food trucks that sell alcohol and other businesses that participate in multiple events per year.

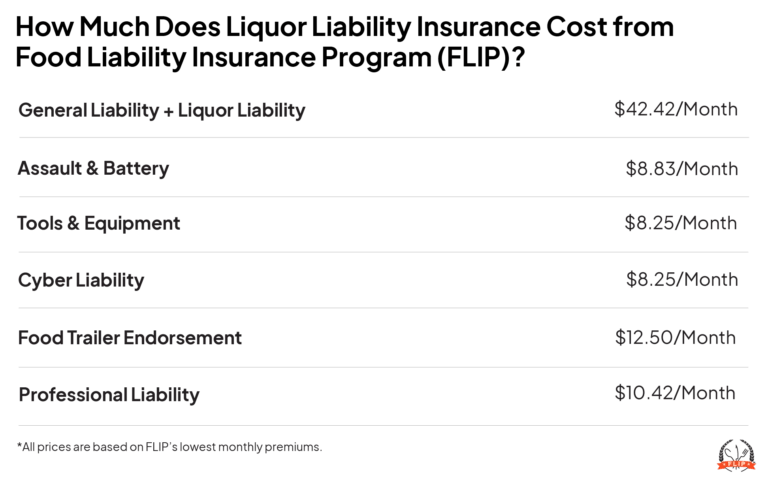

If you choose an annual policy, you can also select optional coverage for an additional cost, including:

- Inland Marine (Tools and Equipment)

- Cyber Liability Insurance

- Food Trailer Endorsement

- Workers Compensation Insurance

- Professional Liability Insurance

Where you operate is another important factor in determining your premiums. Each state has dram shop laws that determine the level of liability, graded on a scale of 0 to 10. The higher the grade, the higher the cost of liquor liability insurance.

Your gross annual income also influences dram shop insurance costs. Businesses that bring in more money tend to carry more risk due to the higher volume of customer interaction and alcohol sales. This is why insurance for a high-volume caterer is more expensive than for a part-time bartender.

Can I Reduce the Cost of My Insurance?

FLIP works hard to ensure you get the lowest rates possible when you buy liquor liability insurance. Costly insurance claims can cause your rates to go up, so the best way to keep your premiums low is to minimize risk.

Even bartenders can be held liable if they accidentally overserve a customer or provide alcohol to an underage patron. Here are some tips to help you avoid these pitfalls and keep your rates down:

- Always check identification before serving a guest.

- Complete safe service training like TiPS Alcohol Safety Training.

- Learn to recognize signs of intoxication.

- Cut off patrons who are visibly drunk.

- Make water readily available and provide free soda or mocktails for designated drivers.

Why FLIP for Affordable Liquor Liability Insurance?

A+ Rated Coverage

Customizable Policy

Annual and Event Coverage Options

Free & Unlimited Additional Insureds

24/7 Online Access

Instant Certificate of Insurance

Coverage Details Limits

General Liability Aggregate Limit

$2,000,000

Products – Completed Operations Aggregate Limit

$2,000,000

Personal and Advertising Injury Limit

$1,000,000

General Each Occurrence Limit

$1,000,000

Damage to Premises Rented to You Limit (Any One Premises)

$300,000

Liability Deductible

NO DEDUCTIBLE

Business Personal Property / Inland Marine Limit (Any One Article / Aggregate)

$5,000/$10,000

Business Personal Property / Inland Marine Limit (Per Occurrence) – Deductible

$250

Medical Expense Limit

$5,000

How Do I Get a Quote?

Get a quote and buy your policy online in four easy steps:

2. Select your business activities

3. Fill out the required information

4. Get your free quote and finish checking out!

FAQs About the Cost of Liquor Liability Insurance

What Is an Example of a Liquor Liability Claim?

- An intoxicated guest leaves a wedding reception and backs their car into the venue’s deck, causing severe damage. The venue expects the caterer to pay for repair costs.

- A bartender accidentally serves a minor who then drives off the road and suffers injuries. The bartender is legally responsible for the driver’s medical bills.

- Two drunk customers get into a bar fight, sending both to the hospital. They both sue the bartender for medical bills and legal fees.

Is Liquor Liability Insurance Mandatory for My Business?

Liquor liability coverage is mandatory in some states for obtaining a liquor license. Even states that don’t require it strongly recommend that bartenders carry liquor liability insurance. A single claim can be financially devastating, but insurance can absorb some or all of those risks.

Does General Liability Insurance Include Liquor Liability Coverage?

General liability insurance only covers business-related claims associated with third-party injury or property damage; it specifically excludes anything involving the sale or service of alcohol. If you operate an alcohol-serving business, you need both general liability and liquor liability coverage.

What Types of Businesses Need Liquor Liability Insurance?

Any business that sells, serves, or provides alcohol as a primary part of its operations needs liquor liability insurance. This includes:

- Bartenders

- Caterers

- Event and wedding vendors

- Food trucks

- Personal chefs

What Happens If I Don’t Have Liquor Liability Insurance and a Claim Is Made?

If a claim is made against your business and you don’t have liquor liability insurance, you are responsible for paying out of pocket. This can include expensive medical bills, repair costs, and legal fees.

Reviewed by: Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.