Primary and Noncontributory

What Is a Primary and Noncontributory Endorsement?

The primary and noncontributory endorsement is a form you can add to your liability insurance policy that determines how it interacts with other policies to cover a claim.

This endorsement is often requested to ensure clarity and reduce potential disputes over which policy should pay in the event of a claim when one or more policies could respond to the same loss.

What Does Primary and Noncontributory Mean?

The meaning of the primary and noncontributory endorsement is that your insurance policy will respond first in the event of a covered claim without seeking financial contributions from any other active policies that could also cover that claim.

How the Primary and Noncontributory Endorsement Works

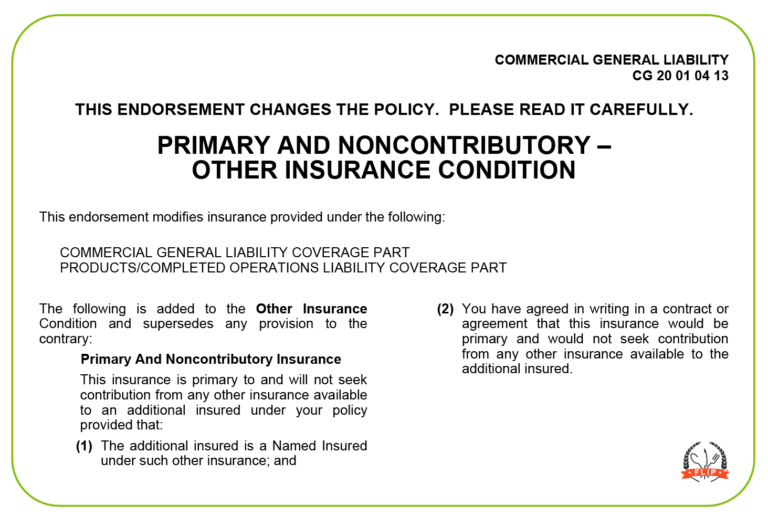

The primary and noncontributory endorsement is made up of two parts that work in tandem with each other.

- Primary: This portion defines your policy as the primary one, meaning it will pay out first in the event of a claim before any other active policies that could cover the same claim.

- Noncontributory: This second part of the endorsement states that your policy will pay out without expecting contributions from any other policies that would also cover the same claim.

When both terms are used together — primary and noncontributory — it means that your insurance policy will pay first (primary) and will not seek contributions from other insurance policies (noncontributory).

Primary and Noncontributory vs. Waiver of Subrogation

The primary and noncontributory endorsement states that your insurance company will not seek contributions from other active policies that could cover the same claim.

The waiver of subrogation is also an endorsement you can add to your policy at the request or requirement of a third party. It means your insurance company cannot seek reimbursement from a third party that may have caused the claim.

Additional Insured vs. Primary and Noncontributory

When you add an additional insured to your policy, you extend your liability coverage to that third party and add them to your Certificate of Insurance. This means you protect them from any claims arising from your negligence and operations.

Additional insureds often go hand in hand with primary and noncontributory endorsements. For example, if you’re renting a commercial kitchen, the landlord may require you to name them as an additional insured on a primary and noncontributory policy.

This combination ensures two things if a claim is filed:

- The additional insured has coverage under your policy

- Your policy will pay out first without seeking contribution from the additional insured’s other policies

Primary and Noncontributory Example

When Is Primary and Noncontributory Insurance Needed?

You only need to add the primary and noncontributory endorsement to your policy if a third party requests it in a contract or other agreement. These third parties typically include landlords, clients, and event organizers.

If you are an event organizer and need to require your vendors to add this endorsement to their policies, FLIP can help!

When you partner with us to make sure all of your vendors are properly insured, we will ask you which endorsements you require your vendors to have. Then, before your event, we check to make sure all of them have the proper endorsements and call any who still need to purchase them.

Learn more about the benefits of partnering with FLIP and take some of the stress out of throwing your next event!

How to Get Primary and Noncontributory Coverage on Your Policy

FLIP makes it easy to add a primary and noncontributory endorsement to your policy for just $20.

To request one, simply follow these steps:

- Log in to your user dashboard

- Navigate to “Manage Policies” and click on “Add Endorsement”

- Select “Primary, Noncontributory” from the list of endorsements and click “Request”

After one of our licensed customer service agents has reviewed your request, you will receive an email notification letting you know if it’s been approved. You will not be charged until the request has been approved.

Read More

- See also: Waiver of Subrogation

- See also: Additional Insured

- See also: Certificate of Insurance

- See also: Liability