Farmers Market Vendor Insurance Cost

If you’re wondering about the cost of farmers market insurance, you’ve come to the right place. Get answers to all of your questions and feel confident you’re getting the best bang for your buck.

How Much Does Farmers Market Insurance Cost?

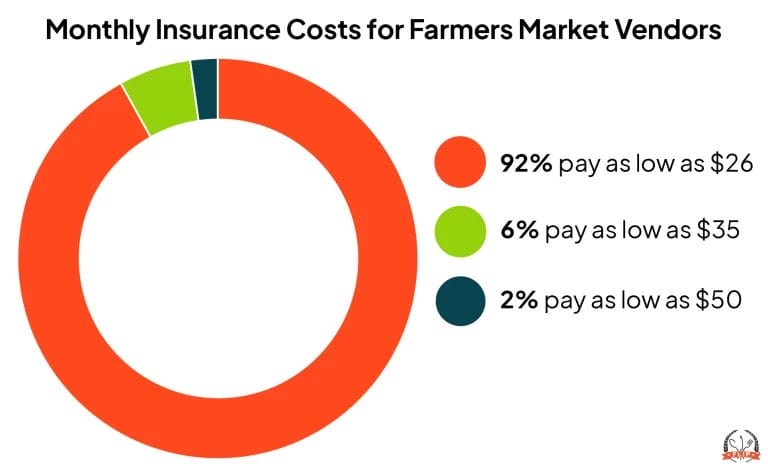

Farmers market insurance starts at $25.92 per month or $299 per year and includes third-party bodily injury, property damage, and product liability coverage.

How Much Does Each Type of Coverage Cost?

What Factors Affect Farmers Market Insurance Cost?

The cost of your insurance premium can be impacted by a few factors. For example, the amount you pay for general liability insurance depends on how much your business earns per year.

The second factor that can influence the cost of your premium is the type of coverage you choose. FLIP offers different policies and add-ons, including:

- Inland Marine (Tools and Equipment)

- Liquor Liability Insurance

- Cyber Liability Insurance

- Food Trailer Endorsement

- Workers’ Compensation Insurance

- Professional Liability Insurance

Having the cheapest farmers market insurance doesn’t necessarily mean you’ll have all the coverage you need. FLIP makes it affordable to customize your policy with extra coverages that provide quality protection for your business.

And lastly, if you have a history of filing expensive claims, your premium may increase. When a business has filed multiple claims in the past, they post more of a financial risk. In turn, insurance companies raise premiums to offset this risk.

Can I Reduce the Cost of My Insurance?

At FLIP, we’re serious about offering you the best possible coverage for the best possible price. You can keep your farmers market vendor insurance costs low by preventing accidents from occurring in the first place.

Incorporate risk management strategies into your business operations, including:

- Keeping the area in and around your farmers market booth or food truck clear of any potential tripping hazards

- Following proper food safety and storage practices

- Clearly labeling allergens on your menu and/or packaging

- Never leaving expensive equipment like generators unattended or out of your sight

Why FLIP for the Best Farmers Market Insurance?

A+ Rated Coverage

Customizable Policy

Monthly and Yearly Payment Options

Free & Unlimited Additional Insureds

24/7 Online Access

Instant Certificate of Insurance

Coverage Details Limits

General Liability Aggregate Limit

$2,000,000

Products – Completed Operations Aggregate Limit

$2,000,000

Personal and Advertising Injury Limit

$1,000,000

General Each Occurrence Limit

$1,000,000

Damage to Premises Rented to You Limit (Any One Premises)

$300,000

Liability Deductible

NO DEDUCTIBLE

Business Personal Property / Inland Marine Limit (Any One Article / Aggregate)

$5,000/$10,000

Business Personal Property / Inland Marine Limit (Per Occurrence) – Deductible

$250

Medical Expense Limit

$5,000

How Do I Get a Quote?

Getting your quote from FLIP is super easy and most people can get theirs in 10 minutes or less! Just follow these four simple steps:

2. Select your business activities

3. Fill out the required information

4. Get your free quote and finish checking out!

FAQs About the Cost of Farmers Market Insurance

Can I Get Short-Term Insurance for Seasonal Markets?

While FLIP doesn’t currently offer short-term or event insurance for farmers market vendors, we have budget-friendly monthly payment options. This allows you to pay for the coverage you need when you need it.

Do I Need Insurance to Sell at a Farmers Market?

Yes — if you want to become a vendor at a farmers market, having insurance is crucial. Most farmers markets require you to submit proof of insurance before they’ll allow you to participate as a vendor.

In many cases, they may also ask you to add them to your policy as an additional insured so they aren’t held financially responsible for any accidents you cause.

Advertising yourself as an insured vendor can also help you sell more at farmers markets because it demonstrates professionalism and shows customers that you’re prepared in case something goes awry.

Is Product Liability Included in Farmers Market Insurance?

Yes! A base policy from FLIP includes product liability insurance to shield you from the financial impact of food poisoning or unlabelled allergen claims.

Reviewed by: Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.