Food Business Insurance Cost

Food Liability Insurance Program (FLIP) has the answers to all of your food insurance cost questions.

How Much Does Food Liability Insurance Cost?

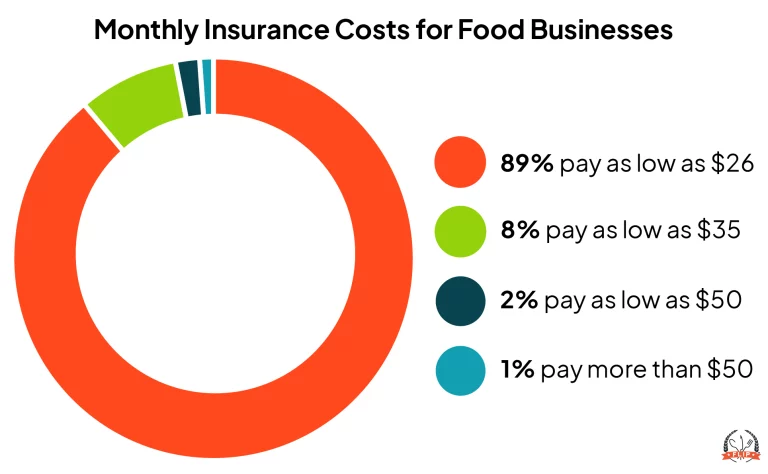

The cost of food liability insurance starts at $25.92 per month or $299 per year.

FLIP covers a wide range of food professionals for some of the most common claims, including third-party bodily injury, property damage, and product liability.

Several factors can influence the final monthly cost of your premium:

- How much your business makes

- The additional coverage you select

- Whether or not you have previous claims

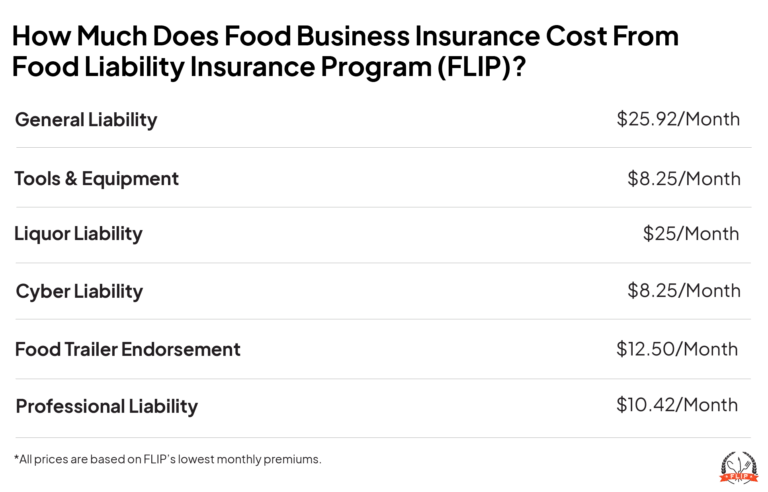

How Much Does Each Type of Coverage Cost?

What Factors Affect Food Insurance Cost?

FLIP considers several factors when calculating food business insurance costs. First, the price of your insurance depends on your business’s gross annual income.

Businesses that bring in more revenue carry a higher risk of loss. To offset those potential costs, higher income results in higher premiums.

The options you select also influence your food insurance costs. FLIP’s base pricing only includes general liability insurance. You can expand or extend your protection by adding optional coverage, including:

- Inland Marine (Tools and Equipment)

- Liquor Liability Insurance

- Cyber Liability Insurance

- Food Trailer Endorsement

- Workers’ Compensation Insurance

- Professional Liability Insurance

The last major factor that determines your premium is your claim history. If you made pricey claims in the past, you may see your premiums increase.

Previous claims tell your insurance company that your business could present a higher risk. To offset this potential cost, your policy prices may increase.

Can I Reduce the Cost of My Insurance?

Taking preventative measures to mitigate your risk is the best way to keep food business insurance costs low. You can do this in a variety of ways, including:

- Remove any tripping, slipping, or fall hazards from customer areas

- Follow the first-in-first-out (FIFO) rule when rotating stock

- Adhere to all safe food handling guidelines

- Clean and maintain your equipment according to the manufacturer’s instructions

Accidents happen, but you can save yourself a lot of money and stress by being proactive in protecting your business.

Why FLIP for the Best Food Business Insurance?

A+ Rated Coverage

Customizable Policy

Monthly and Yearly Payment Options

Free & Unlimited Additional Insureds

24/7 Online Access

Instant Certificate of Insurance

Coverage Details Limits

General Liability Aggregate Limit

$2,000,000

Products – Completed Operations Aggregate Limit

$2,000,000

Personal and Advertising Injury Limit

$1,000,000

General Each Occurrence Limit

$1,000,000

Damage to Premises Rented to You Limit (Any One Premises)

$300,000

Liability Deductible

NO DEDUCTIBLE

Business Personal Property / Inland Marine Limit (Any One Article / Aggregate)

$5,000/$10,000

Business Personal Property / Inland Marine Limit (Per Occurrence) – Deductible

$250

Medical Expense Limit

$5,000

How Do I Get a Quote?

Get your food business insurance quote and get covered in 10 minutes or less with these four easy steps:

2. Select your business activities

3. Fill out the required information

4. Get your free quote and finish checking out!

FAQs about the Cost of Food Business Insurance

What Types of Coverage Are Included in Food Business Insurance?

FLIP’s basic food business insurance is a general liability policy that covers third-party claims, including:

- Bodily injury

- Property damage

- Product liability

- Personal and advertising injury

- Damage to Premises Rented to You

You can add optional coverage to your policy if you need more protection. These add-ons will increase the final price of your premium.

Can I Bundle Different Types of Insurance for My Food Business?

Yes! FLIP offers comprehensive coverage that allows you to customize your policy with optional add-ons, such as cyber liability or tools and equipment insurance. You can select your coverage so you only pay for the coverage you need.

Reviewed by: Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.