Catering Insurance Cost

How much is catering insurance, and how is that cost determined? We’ve got answers to both those questions and more so you can purchase your policy with confidence.

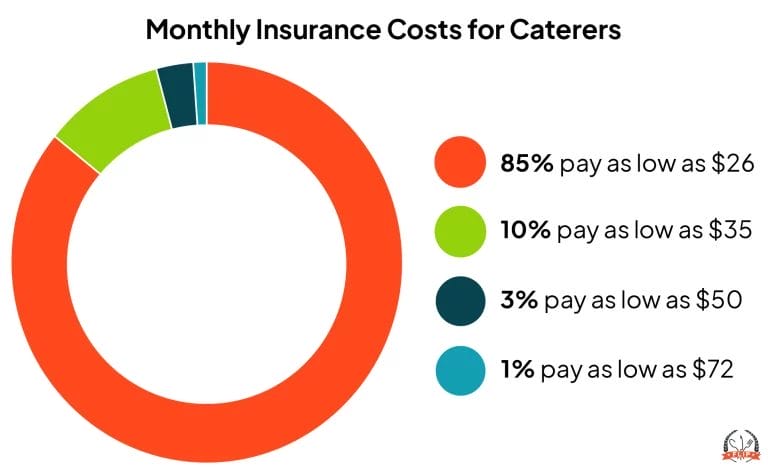

How Much Does Catering Insurance Cost?

You can get catering liability insurance from Food Liability Insurance Program (FLIP) for as low as $25.92 per month or $299 per year. Our base policy includes coverage for third-party bodily injury, property damage, and product liability.

When the average catering claim is over $4,000, it’s easy to see how having the right policy is one of the best investments you can make for your business’ success.

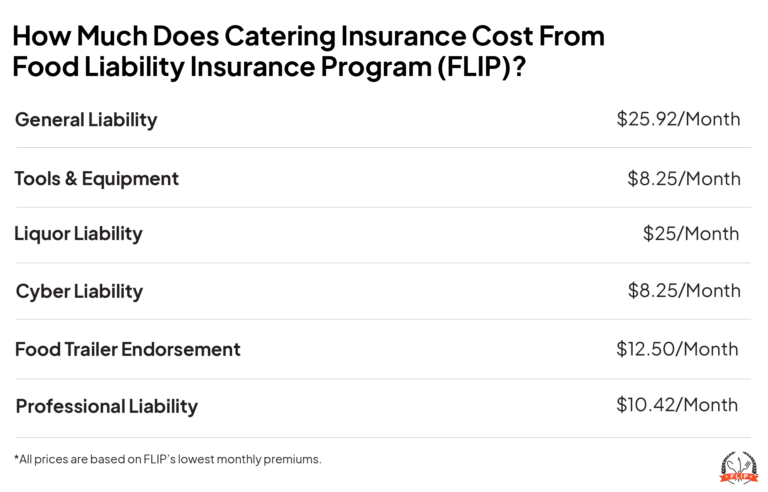

How Much Does Each Type of Coverage Cost?

What Factors Affect Catering Liability Insurance Cost?

There are a few key factors that can impact the cost of your insurance premium. For example, the cost of your general liability insurance is affected by how much your business makes annually.

Your premium is also affected by the type of coverage you choose. When you get a policy from FLIP, you have the option to expand your coverage with other policies and add-ons, including:

- Inland Marine (Tools and Equipment)

- Liquor Liability Insurance

- Cyber Liability Insurance

- Food Trailer Endorsement

- Workers Compensation Insurance

- Professional Liability Insurance

While adding optional coverages to your policy does increase your catering insurance cost, FLIP keeps prices low so you don’t have to choose between affordability and the coverage your business needs.

Lastly, your premium may increase if you have a history of filing expensive claims. Businesses that have filed multiple claims pose more of a financial risk than those that haven’t, so insurance companies raise premiums to compensate for this.

Can I Reduce the Cost of My Insurance?

FLIP is proud to offer affordable, competitively priced policies. To keep the cost of your catering insurance low, you can avoid paying higher premiums by incorporating risk management strategies into your business practices.

Some of the best ways to prevent catering accidents include:

- Adhering to proper food safety and storage practices

- Clearly marking dishes that include common allergens with easy-to-read signage

- Promptly cleaning up spills and placing wet floor signs to alert guests

- Ensuring your equipment is regularly maintained and serviced to prevent malfunctions or breakdowns

Why FLIP for the Best Catering Insurance?

A+ Rated Coverage

Customizable Policy

Monthly and Yearly Payment Options

Free & Unlimited Additional Insureds

24/7 Online Access

Instant Certificate of Insurance

Coverage Details Limits

General Liability Aggregate Limit

$2,000,000

Products – Completed Operations Aggregate Limit

$2,000,000

Personal and Advertising Injury Limit

$1,000,000

General Each Occurrence Limit

$1,000,000

Damage to Premises Rented to You Limit (Any One Premises)

$300,000

Liability Deductible

NO DEDUCTIBLE

Business Personal Property / Inland Marine Limit (Any One Article / Aggregate)

$5,000/$10,000

Business Personal Property / Inland Marine Limit (Per Occurrence) – Deductible

$250

Medical Expense Limit

$5,000

How Do I Get a Quote?

You can get a quote from FLIP in 10 minutes or less! Just follow these four easy steps:

1. Start your online application

2. Select your business activities

3. Complete all required fields

4. Get your free quote and finish checking out!

FAQs About the Cost of Catering Insurance

Do I Need Liquor Liability Insurance if My Catering Business Serves Alcohol?

Yes! General liability insurance does not cover alcohol-related incidents, like mistakenly serving alcohol to a minor or overserving a patron who drives while intoxicated and causes an accident. With liquor liability insurance for caterers, you can get coverage for incidents like these.

What Types of Insurance Do Catering Businesses Need?

One of the top 3 types of insurance catering companies need is general liability insurance to shield against third-party bodily injury and property damage claims. Caterers should also have the following types of coverage:

- Product liability

- Cyber liability

- Tools and equipment

- Liquor liability (if you sell, serve, or provide alcohol as part of your regular business operations)

What Are the Consequences of Not Having Catering Insurance?

Without insurance, your business is financially vulnerable to claims caterers commonly face, including food poisoning, third-party property damage, and damaged equipment.

Each of these incidents can cost you hundreds, if not thousands, of dollars. But with insurance, you wouldn’t be left to pay it all out of pocket.

Is Workers Compensation Insurance Necessary for My Catering Business?

If you have people on your payroll, carrying workers’ compensation insurance is necessary to safeguard your business if an employee seriously injures themselves or dies on the job. In fact, all states except for Texas require workers’ compensation insurance for businesses with a certain number of employees.

Please note that if you live in Ohio, North Dakota, Washington, or Wyoming, you are not eligible to purchase workers’ compensation through FLIP. These states require you to obtain coverage through a monopolistic state fund.

What Should I Look for in an Insurance Provider for My Catering Business?

When you’re considering catering insurance, it’s important to look out for two things:

- What It Covers: A good catering insurance policy will include general and product liability and offer options to cover your business’ personal property.

- How Much It Costs: The cheapest insurance may not offer the robust coverage your business needs, but a good policy doesn’t need to break the bank.

Reviewed by: Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.