Exclusions

What Are Exclusions in Insurance?

Exclusions are events that are not covered by an insurance policy.

Every insurance policy has exclusions that determine the limitations of your coverage.

What Do Exclusions Mean for My Coverage?

When an event is listed as an exclusion on your policy, it means your insurance will not cover any claims or losses arising from that event.

For example, automobiles are excluded under FLIP’s general liability policy. If you cause an auto accident with your food truck, your general liability policy will not cover this claim because it is specifically excluded.

Understanding your policy’s exclusions is critical to knowing what claims it will and will not respond to.

How Do I Find Exclusions in an Insurance Policy?

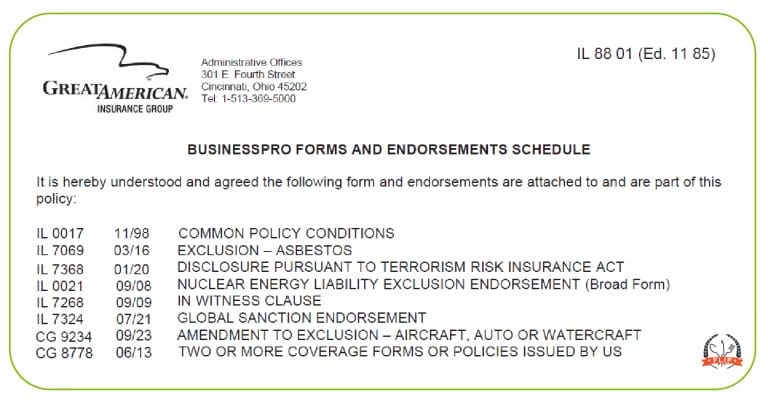

Exclusions are typically found within the policy document and the endorsement list. It’s important to review the entire policy, as each section may have its own set of exclusions.

You can always reach out to our customer service team to discuss your policy exclusions so you have a complete understanding of what your insurance will and won’t cover.

Insurance Exclusions Example

Read More

- See also: Named Perils

- See also: Covered Loss

- General Liability Insurance